A business loan is an excellent way of obtaining the funds you need to develop your business. It can help you cover expenses, buy equipment, launch a new product or service. With the help of a business loan, you can take your business to the next level faster than expected! But as there are many many types of loans with businesses and lenders, it can be hard to know where to start. In this article, we'll cover everything you need to know about how to get a business loan. We'll also look at things to consider before you apply.

What is a business loan?

A commercial loan is a type of loan you can use to finance business expenses, such as new equipment, inventory or working capital. A commercial loan is usually granted by a bank or financial institution. It may or may not be secured, depending on your company's situation.

Secured commercial loans are loans backed by collateral. This may be a property or another asset that you can use as collateral. This means that if you don't repay the loan, the lender can seize the collateral. Unsecured business loans, on the other hand, are not covered by collateral. So the lender takes a greater risk in lending you funds.

The advantages of a business loan

A business loan offers a variety of benefits, including:

- Rapid access to capital: Business loans can provide you with the funds you need to start up or expand your business. develop your business. This can help you cover expenses, buy equipment and launch new products and services.

- Flexible repayment terms : A business loan often comes with flexible repayment terms, allowing you to tailor the repayment schedule to your company's needs.

- Improved cash flow : By taking out a business loan, you can improve your cash flow, enabling you to make larger investments and keep your business running smoothly.

- Tax deductions : Depending on the type of loan you take out, you can deduct the interest payment from your expenses.

The two main types of business loan

When it comes to business loans, there are two main solutions. The first is what's known as «equipment credit». Also known as SME credit or business credit. The second is «operating credit» or «line of credit». Here are the main differences between these two types of business loan.

Operating credit :

An operating credit is a loan granted to a company to cover current expenses and working capital requirements. It is generally a line of credit that provides the company with liquidity. This enables the company to pay suppliers, meet unforeseen expenses or invest in new equipment. short-term projects. Operating credit is generally repaid from the cash flow generated by the company's current activities. Terms and interest rates depend on the company's financial situation and solvency.

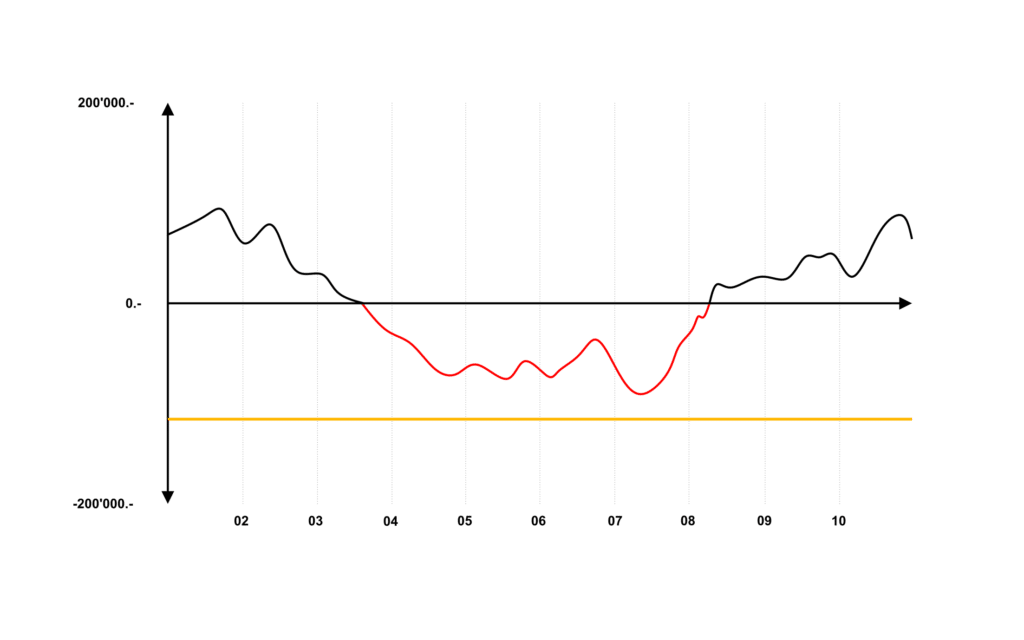

This example of an operating loan shows the cash flow on a company's current account. Over a 10-month period. In yellow is the credit limit set by the bank. In red, the period during which the company uses the credit line (negative).

A business loan in the form of an operating credit generally requires no amortization. In other words, the company has no obligation to repay its debt. However, interest rates and charges are often relatively high.

Equipment or commercial credit :

Equipment or commercial credit is a type of loan designed to finance the purchase of equipment, materials or durable goods for a company. It may be granted in the form of an installment loan or a lease. Equipment loans are generally repaid over a period of 12 to 120 months. Terms and conditions depend on the amount of the loan requested, the type of equipment purchased and the creditworthiness of the company. Financial institutions and banks are the main suppliers of equipment loans. However, in Switzerland, cantons can also set up equipment credit schemes. financing programs for companies and start-ups.

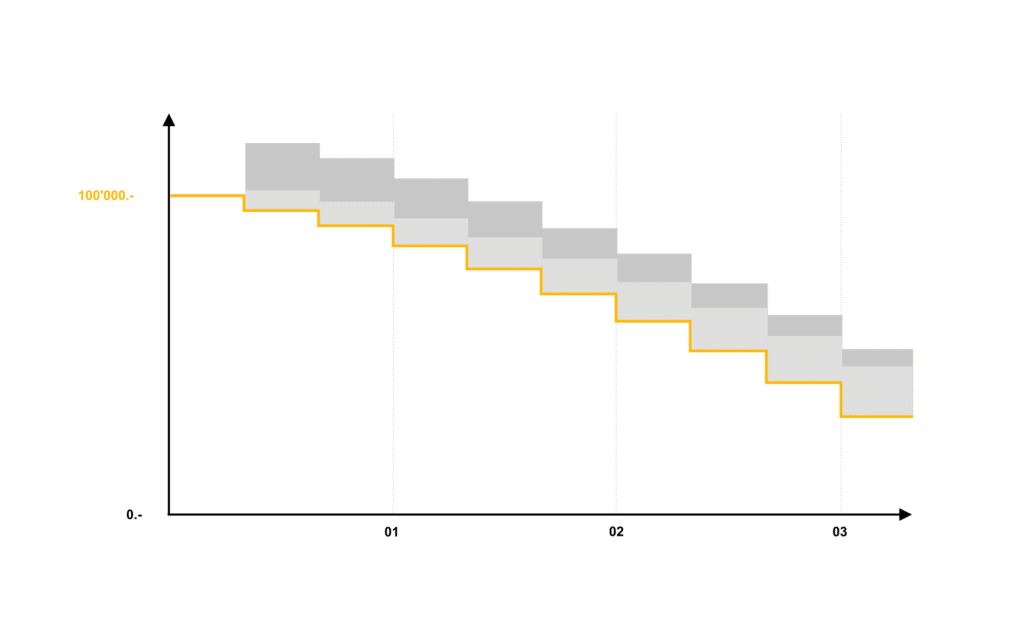

In this example of an equipment loan, we see that the company has borrowed $100,000. It will repay the loan at regular intervals over a 3-year period. In this form of business loan, the monthly payment is fixed throughout the repayment period. This is despite the fact that the amortization portion of the loan is increasing, while the interest payment is decreasing.

In addition to a generally advantageous interest rate, equipment credit offers great freedom of use. A company could, for example, combine several projects into a single financing package, or consolidate other pre-existing debts.

How can you obtain credit for your business?

Once you've decided to obtain your business loan, the first step is to apply for credit. Since there are a multitude of lenders, it's essential to use the services of an independent intermediary, such as Lica.

Once you've completed your application. A Lica business credit advisor will contact you to understand your needs and objectives. Next, you'll usually be asked to provide some basic information about your company, such as its name, address and contact details. You'll also need to provide various documents. These may include financial statements or other evidence of your company's solvency.

Once we've reviewed your application, we'll let you know as soon as possible whether or not your business loan has been approved. If it is, you'll be able to quick access to funds you need.

What documents are required for a business loan?

When you apply for credit, you need to provide certain basic information, such as your company name, address and contact details. You must also provide certain documents so that the lending institution can determine your ability to repay the loan.

The specific documents you need will vary depending on the loan type and the lender. However, the most common documents you will need to provide are the following:

- Financial statement for the past 2 years

- Bank statement for the last 6 months

- Copy of latest company tax return

- Certificate from the company's debt enforcement office

Depending on the company's situation and financing experience, the lending institution may sometimes ask for additional guarantees. This could, for example, involve an additional surety or a personal guarantee from the director(s) of the company wishing to benefit from the business loan. In this case, additional documents may be requested before the loan is finalized.

Frequently asked questions about business loans :

When it comes to business loans, there are a few common questions many people ask before making an application. Here are some of the most common questions:

- How long does it take to get a commercial loan? The time it takes to obtain a commercial loan varies according to the type of loan you take out and the lender. However, most lenders can provide you with funds within a few days.

- How much can I borrow? The amount you can borrow will depend on your company's situation and your project. At Lica, we grant loans from CHF 50’000.- and up to CHF 10’000’000.-.

- What documents do I need to apply for a commercial loan? The documents you need will be requested by your Lica consultant. You will receive a list of the required documents as soon as your request has been made.

- What is the interest rate on a commercial loan? The interest rate on a commercial loan varies according to your company's situation. But it also depends on the terms and conditions we are able to obtain for you. As a’neutral, independent intermediary, Lica negotiates the best possible terms for you with Switzerland's leading lending institutions. Generally speaking, the rate for a business loan varies between 2% and 12%.

Our conclusion on business loans

A business loan is an excellent way of obtaining the funds you need to launch or expand your business. It can provide you with the capital you need to cover expenses, buy equipment and expand your business. launch new products and services. With the help of a business loan, you can take your business to the next level!

If you're looking for a business loan, apply for financing today! The financing solutions offered by Lica are non-binding and the most advantageous on the Swiss market.

When you use Lica's services, you're guaranteed significant savings by obtaining the best terms and conditions on the market. Your business credit specialist is there to guide you and help you make the right decisions. By relying on an independent intermediary like Lica, you can be sure of receiving the best advice. You'll benefit from the best business credit solution in Switzerland.