What could be more frustrating than not being able to obtain credit because of a lawsuit? The Federal Consumer Credit Act (LCC) is precise on this subject. Article 22, for example, states that the purpose of an examination of credit-worthiness is to prevent overindebtedness resulting from a consumer credit contract. In short, it's impossible to take out credit with a lawsuit!

However, there is a totally legal way to obtain credit with lawsuits. We'll explain it to you in this new article. Enjoy your reading.

Obtain credit with lawsuits using a trusted third party

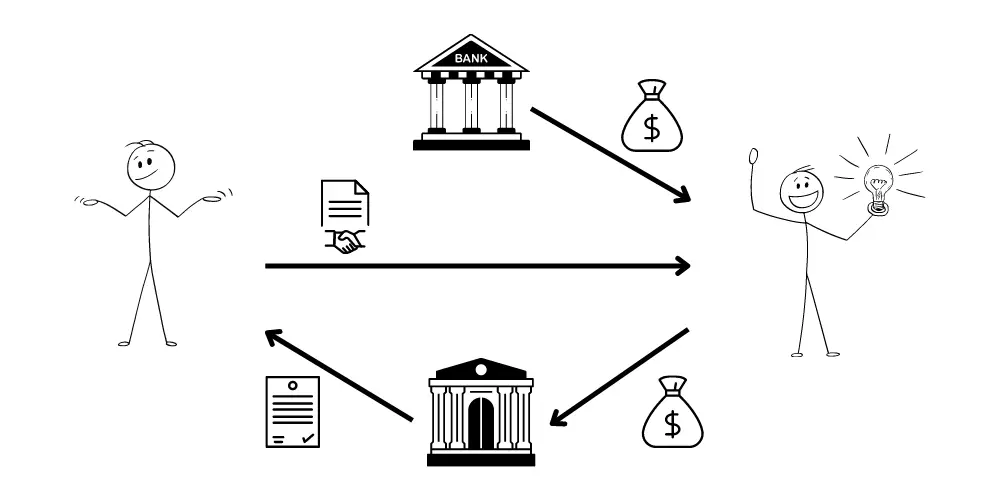

If you want to obtain credit with a lawsuit, there's a solution in the form of a trusted third party. If this person is eligible to grant private credit, he or she will be able to help you in the process, enabling you to obtain quick credit. Here's how it works:

1. Intervention of a trusted third party

The first step is to find someone you trust. This person will have to agree to borrow the amount equivalent to the total of your lawsuits. Once the right person has been found, the credit application should be accepted without difficulty.

The funds are then paid to the third party who arranged the credit. They will then reimburse your debts in full in exchange for a acknowledgement of debt that you will have drawn up beforehand. To draw up a formal IOU, please consult the following article « How to draw up an IOU in Switzerland »You can also ask your Lica advisor to take care of this for you when you apply for a loan.

2. Take out your loan and repay the third party

Now that the third party has paid off your debt, you're once again solvent and eligible to apply for private credit. In practice, once you have a clean statement of debt, you can apply for a perfectly legal credit application. As soon as you receive the funds, you repay them to the third party who helped you. In exchange, the third party will cancel the IOU that you and the third party previously agreed upon. You are now debt-free, and the third party has also repaid his or her credit in full. Everyone's back on track!

Is there a risk to the third party?

In some cases, third parties may be concerned about this approach, and that's normal. However, in reality, the risk is extremely low or non-existent for the following reasons:

- Once you've obtained credit, the third party pays off your debts. You are now solvent again, and acknowledgement of debt (debt security) can be used at any time by the third party to claim repayment. In this worst-case scenario, the person would be seized by the debt-collection office, and the third party would receive a monthly refund.

- You can insure yourself against life's unpredictable events. Whether it's unemployment, disability or death, These risks can be insured for the benefit of the third party. This means the third party can be sure of being reimbursed, whatever happens to you!

The process is therefore very secure, and you are of course accompanied by one of our credit specialists. He or she will tell you how and when to proceed.

Protect yourself in the event of death, disability or unemployment to obtain credit with legal proceedings

Life is unpredictable! Indeed, no one is immune to accident, illness or unemployment. To protect yourself against these risks, it's perfectly possible to take out insurance to reassure a third party. The third party will also be protected should anything happen to you during the financial transaction. Here are the different solutions we recommend to protect you in the event of obtaining credit with legal proceedings :

- Loss of earnings insurance in the event of unemployment, illness or accident. This is often a sum insurance policy with which you can receive a monthly allowance in the event of unemployment, illness or accident. So, in the event of unforeseen circumstances, you remain solvent and can honor your financial agreement.

- 3B death risk insurance with an irrevocable clause. Death insurance in this form allows you to irrevocably designate a capital beneficiary. In other words, the insured person and the beneficiary (the third party) are permanently linked for the duration of the contract. In this way, the third party is guaranteed to receive the sum borrowed in the event of the debtor's death.

With these two protections, the third party who will be taking out the loan is totally reassured that he or she will be reimbursed no matter what!

Here too, take advantage of free Lica services to guide you through the process and ensure that everything runs smoothly.

Lica helps you obtain credit with lawsuits

Obtaining credit through legal action requires a good understanding of the laws and the financial system in Switzerland. That's why we strongly recommend that you enlist the help of the credit specialist in Switzerland. Whatever your situation, you can count on our staff to help you! Whether you need :

- Setting up an IOU

- Get the right insurance coverage

- And finally, get your private credit with lawsuits

Lica is here to help!

As an independent intermediary, Lica works for its customers with complete neutrality. Our advisors take the time to listen to you, and to find the solution you need from among the multitude of solutions available on the market. With online credit application With Lica, you can be sure of our support throughout your project.

Now that you know that lica is at your side, take the time to contact our specialists by completing a no-obligation online credit application. They will guide you through the process in a neutral and confidential manner.