Interest rates in Switzerland have been rising for several months. Many factors are behind this rise, from central bank policies to the global economy. As a result, it's important for consumers to understand the implications of this rise and how it may affect their ability to access consumer credit in Switzerland. In this new article, we look at the regulation of consumer credit in Switzerland, the evolution of interest rates, the impact of rising interest rates on loans, and strategies to combat rising interest rates. We hope you enjoy reading!

How are interest rates set on consumer loans?

Interest rates on private credit, These rates depend on a number of players and factors. Here's an overview of who does what before you can determine the interest rates on private loans in Switzerland.

The Swiss National Bank and the Federal Council

Interest rates in Switzerland are set by the Swiss National Bank and the Federal Council. The Swiss National Bank is responsible for setting the reference interest rate (policy rate). It is then used as the basis for interest rates on loans and deposits. For lending institutions, the aim is to carry out financing operations at the lowest possible cost. The aim is to obtain funds as cheaply as possible and then lend them out at a profit. The Federal Council sets the maximum interest rate applicable to consumer credit. These two rates are closely linked and influence the general level of interest rates on consumer credit.

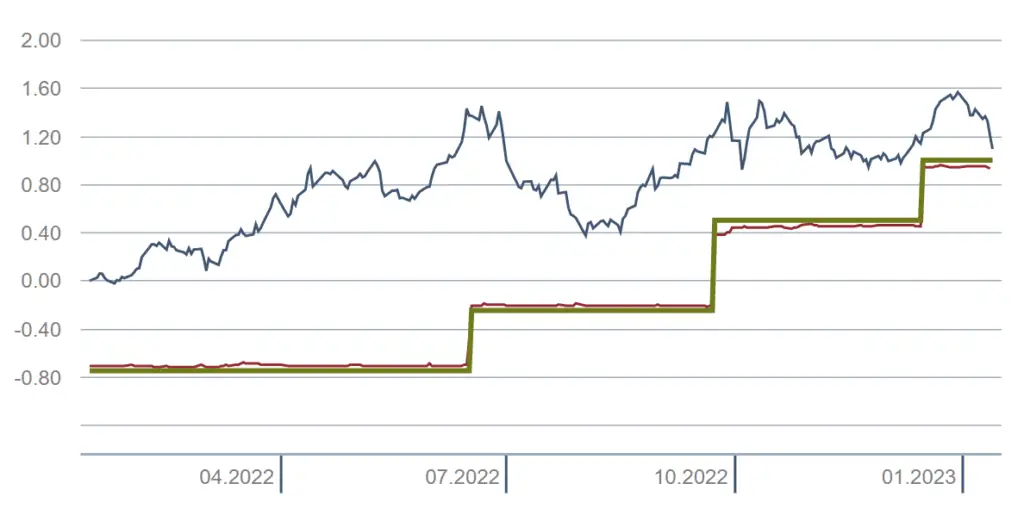

Here is the key rate trend over the last 12 months of 2022:

Lending institutions

Once the key interest rate and the maximum borrowing rate have been set, interest rates for loans are then determined by the lending institutions themselves. This is based on their own interest rate policy and credit risk. Interest rates may vary depending on the duration and amount of the loan. But also according to the financial situation and risk profile of the loan applicant. Although highly regulated, the private credit business is evolving in a changing environment. a highly competitive market. It is therefore important for lending institutions to keep their interest rates as low as possible.

FINMA regulations and ordinance issued by the Department of Justice and Police (DFJP)

Lastly, it is important to note that lending institutions are subject to cantonal regulations as well as to the supervision of the Swiss Banking Commission. FINMA (Swiss Financial Market Supervisory Authority). Its mission is to protect the interests of consumers, maintain the stability of the Swiss financial system and monitor the best practices of lending institutions. The Federal Department of Justice and Police (FDJP) announces the maximum interest rate for consumer credit. This is done on the instructions of the Federal Council, through the publication of an ordinance (see LCC and OLCC). Until now, the maximum rate has been set at 10 % for consumer credit and 12 % for credit cards.. Given the current rise in interest rates, it is highly likely that these two rates will be readjusted in the coming months!

In a nutshell:

The Swiss National Bank sets the key interest rate, and the Federal Council sets the borrowing rate. Based on these two reference rates, lenders can then determine the interest rates they will charge on their loans. private credit. This takes into account various personal and competitive factors. At the same time, FINMA and the Federal Department of Justice and Police (FDJP) are keeping a close watch to protect consumers and prevent any excesses!

The impact of interest rates on consumer credit in Switzerland

Interest rates have a major impact on consumer credit in Switzerland. When interest rates are low, it's easier for consumers to borrow. take out loans. They can access credit at a lower cost. Conversely, when interest rates are high, it is more difficult for consumers to access credit, as the cost of borrowing is higher.

Interest rates also have an impact on the amount of debt that consumers can take on. When interest rates are low, consumers can take on more debt, because the cost of servicing the debt is lower. When interest rates are high, it can be more difficult for consumers to access credit. This is because, conversely, the cost of servicing debt is higher.

Recent trends in interest rates on consumer credit in Switzerland

Interest rates on consumer loans in Switzerland are likely to rise significantly in the months and years ahead. This is partly due to the Swiss National Bank's policy of raising the target rate. Its mission is to counter inflationary pressures in the Swiss economy. The Saron rate in Swiss francs has also risen steadily in recent months. This rise in rates will therefore have a direct impact on interest rates that consumers pay for their credit.

In addition to the policies of the Swiss National Bank, the recent rise in interest rates is also due to the global economy. For example, the US Federal Reserve raised its benchmark interest rate, which also had an impact on the Swiss economy. As a result, interest rates on loans in Switzerland will certainly follow this upward trend.

Impact of rising interest rates on consumer credit in Switzerland

Rising interest rates on consumer credit in Switzerland will have a definite impact on consumers. On the one hand, it will be more difficult for consumers to access credit, as the cost of borrowing will have risen. This is particularly true for low-income households. They are more likely to find themselves refuse a loan because their borrowing capacity is lower.

Rising interest rates will also have an impact on the amount of debt consumers can take on. As the cost of servicing debt rises, many consumers will be forced to reduce their debt levels. This is to avoid defaulting on their loans. This is likely to have a relatively significant impact on the economy, as consumers will have to reduce their expenses.

Strategies for managing rising interest rates on consumer credit

With interest rates on consumer credit set to rise in Switzerland, it's important that consumers are aware of the strategies they can use to mitigate the financial impact.

One of the most effective strategies is to find the best interest rate. Different lenders can offer different interest rates on consumer loans. It is therefore important for consumers to compare offers from different lenders in order toget the best conditions. Consumers should also consider buy back their existing loansThis can help them reduce their monthly expenses.

It's also important for consumers to establish a prudent budget. This can help them avoid taking on too much debt and defaulting on loans. Consumers should also consider consolidate their debts. This can help them reduce their interest payments by reducing the number of loans they have to manage.

A consumer credit in Switzerland remains an advantageous solution

Despite rising interest rates on consumer credit in Switzerland, taking out a loan still has many advantages. Firstly, it can give consumers access to funds they might not otherwise have access to. This can help them to cover unforeseen expenses, or to make a major purchase that they might not otherwise be able to afford.

Consumer credit can also help consumers to improve their credit rating. By taking out a loan and making payments on time, consumers can demonstrate to lenders that they are responsible borrowers. This can improve their chances of accessing credit in the future.

FAQ on rising consumer credit interest rates in Switzerland

What's behind the rise in interest rates for consumer credit in Switzerland?

The main reason for the rise in interest rates for consumer credit in Switzerland is the National Bank's policy of responding and adapting to the global economic situation. The Swiss National Bank has raised its target and discount rates to counter inflationary pressures in the economy. The US Federal Reserve has also raised its benchmark interest rate, which has also had an impact on the Swiss economy.

How can I manage rising interest rates on my consumer loans in Switzerland?

There are a number of strategies you can use to manage rising interest rates on consumer credit in Switzerland. Find the best interest rate may be a good option, as different lenders may offer different interest rates. You should also consider refinancing your existing loans and consolidating your debts to reduce your monthly payments. Finally, a well-established budget can help you avoid taking on too much debt.

Is it certain that interest rates on consumer loans will rise in the coming months?

Probably yes! However, it is still difficult to predict when this increase will take place. The only current certainty is that the increase in key interest rates and borrowing rates is already having an impact on our economy. A rise in consumer credit rates is therefore not an absolute certainty. However, it has a very high probability of materializing in the months or years ahead. It is also not impossible that interest rate rises on private loans will remain low. This is due to the fierce competition in this sector. New players are seeking to position themselves, forcing the various competitors to adapt their conditions to remain attractive.

Will I still be able to obtain credit easily in the years to come?

Access to liquidity through consumer credit is likely to remain an advantageous solution for years to come. It's important to understand that it would be in nobody's interest to make access to consumer credit impossible for the vast majority of consumers. Indeed, when consumers can borrow easily, they also spend more easily in our economy. It's important for consumers to consume, because it keeps the economy going. It stimulates production and creates jobs. Consumers who spend money on goods and services stimulate demand for these products. This in turn encourages companies to produce more to meet that demand. In short, healthy consumption is essential to maintaining stable economic growth. The various players involved will therefore do their utmost to maintain the attractiveness of consumer credit.

Our conclusion on rising interest rates in Switzerland

Interest rates on consumer credit in Switzerland are certain to rise in the months and years ahead. This will have an impact on consumers, as it will be a little more difficult for them to access credit. private loans. The amount of debt they can take on will also certainly be reduced. However, a common interest in maintaining a high level of consumption in Switzerland and the positive effects of a highly competitive market should contain this increase. Consumers will therefore still be able to access consumer credit, but certainly in a more moderate way.

Better safe than sorry...

At the same time, it's important for consumers to be aware of the strategies they can use to manage these rising interest rates. Such as shopping around for the best interest rate and consolidating their debts. It is also important tosecure your income whatever happens. By understanding regulations, the effects of interest rates and strategies for managing rising interest rates, consumers can make informed decisions about their consumer credit. In this way, they can be sure of obtaining the best possible offers !

By using Lica's services, you're guaranteed to save a lot of money by getting the best terms on the market. Your credit specialist is there to guide you and help you make the right decisions. The sooner you get started, the sooner you'll save money every month. By relying on an independent intermediary like Lica, you can be sure of receiving the very best advice. You'll benefit from the best private credit solution in Switzerland.