Growing your business is a key objective on the minds of every entrepreneur reading this article. Whether it's having the cash to seize an opportunity, or making an acquisition that's already been determined, the entrepreneur always needs funds to achieve his or her goals. Lica explains how to obtain a business loan quickly and, above all, the advantages of the solution we offer.

How do I obtain a business loan?

Obtaining SME credit may seem like a long and tedious process. But it's just as easy as applying for a private loan. Contrary to popular belief, only a few documents are required for an initial analysis. Then, if you are eligible for a business loan, you will be asked to provide a few additional documents. But don't panic! Lica is with you every step of the way! Here are the steps you need to follow to obtain a business loan.

1. Make your request

The first step is to complete your SME credit application. It shouldn't take more than a few minutes. Especially if you already know how much credit you want. If you do, you can immediately complete your application using the following link:

Contrary to popular belief, a business credit application consists of just ten questions. These are mainly related to company details and general information about the applicant. So there's no need to prepare any documents at this stage!

2. Transmit the documents requested by the SME credit specialist

On receipt of your business credit application, a specialist will examine your file beforehand. Based on the information received at the time of your application and that available in the Teledata register (CRIF), He or she will be able to determine which documents to ask for. The following is a non-exhaustive list of documents generally required to determine a company's borrowing capacity:

- Annual financial statements (balance sheet, profit and loss account)

- A statement of the company's main bank account

- Latest company taxation

- A copy of the identity document of the director(s)

Depending on the information analyzed in this first list of documents, the business credit specialist may ask you for additional supporting documents to enhance the quality of your file. At Lica, our main objective is to get you financing on the best terms possible. As a result, additional documents are often requested to improve your chances of obtaining the financing you want.

3. Answer any additional questions

On the basis of all the documents received and analyzed, the business credit specialist will certainly ask you a few questions to clarify the situation. These are often questions about account transactions. These cannot always be understood without explanation.

When deciding whether to grant financing, lending institutions need to be sure that the company is sound and that business prospects are good. That's why it's always preferable that your Lica credit advisor to prepare your file before submitting it to lenders.

4. Show a little patience 😅

When you have a project to realize or an urgent situation to resolve, we'd like things to move along very quickly! However, it's important to understand that a lender doesn't have the same priorities as a borrower. A company wants to achieve a specific objective as quickly as possible by receiving funds. A lender, on the other hand, aims to good profitability on the loans it grants to its customers. As speed is often a source of error or misinterpretation, it is only natural that the lender should take some time to analyze a company's situation correctly.

At Lica we're fully aware of your priorities. That's why we're committed to handling your project in record time. Our process As the entire process is digitalized, the people involved in your file can assemble it very quickly before submitting it to the lending institutions. Once your application has been submitted to the banks, we monitor it closely until the loan is granted.

The advantages of SME credit

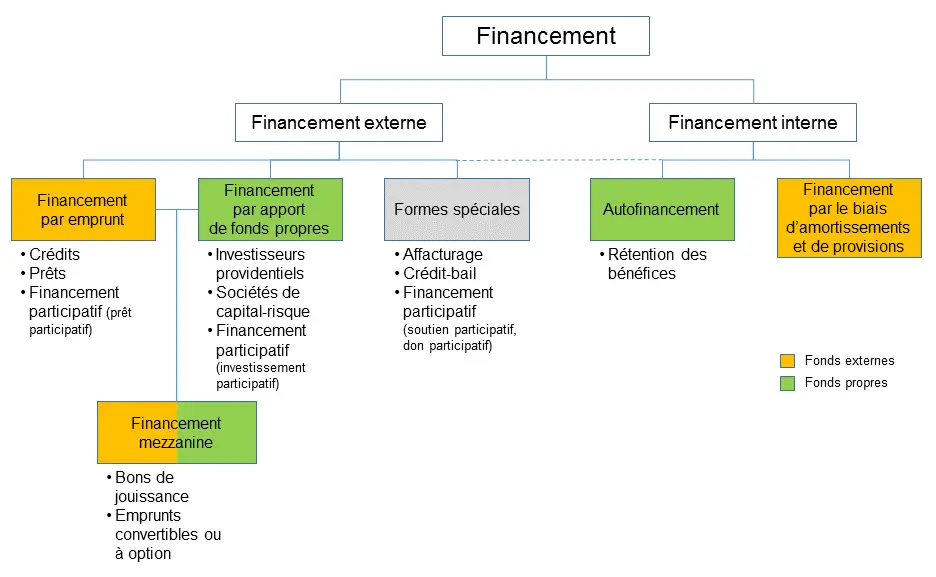

There are many ways for a company to obtain funds. Here's a chart that summarizes all the ways a company can obtain cash. Each of these sources of financing will offer advantages and disadvantages, depending on your company's situation. In this chapter, we'll look at the advantages of business credit.

Unlike the various sources of financing outlined above, business credit is a solution that can be accessed quickly. What's more, the amounts involved are often higher than with internal financing sources. With regard to the comparison between debt financing or equity financing, SME credit requires little or no supporting documentation in the medium to long term. In fact, financing obtained via an investor or a bond issue will require the company to provide regular accounts and a statement of its activities until the sum committed has been repaid. On the other hand, once a business loan has been granted, you no longer need to justify the development of your activities.

Credit benefits for businesses :

- The amount that can be borrowed is often higher

- The underwriting process is relatively quick

- The interest rate is between 2% and 9%

- Repayment terms of up to 7 years

- No need to justify the reason for borrowing over time

Based on these 5 advantages, business credit is an ideal solution for entrepreneurs who need quick and easy access to cash. Depending on your company's situation and your needs, Lica's business credit specialist will guide you to the most appropriate solution. Take the time to make your no-obligation application, and we'll work with you to determine your borrowing options.

The 2 conditions for obtaining a business loan

As with all types of financing, a company must meet certain criteria before it can benefit from business credit. Generally speaking, these are the two points that must be met to secure financing:

- The company must have been in existence for at least 2 years

- Sales must be equal to or greater than CHF 100’000.-.

These two conditions are the only really decisive rules when considering your application. This implies that a company that has a lawsuit or a loss for the current year, could perfectly well obtain financing after analysis of its situation.

What if my company doesn't meet these criteria?

In this case, we can refer you to a private credit solution. This will make it easier for you to obtain liquidity while your business meets the two above-mentioned criteria. Private credit, Depending on your situation, you can obtain between CHF 5’000.- and CHF 400’000.-. This is a substantial sum with which to advance your goal.

Expand your business with Lica's business credit solution

A business loan offers you an attractive opportunity to develop your business. Although there are other sources of financing, business credit remains the best solution for rapid access to cash.

Whether your goal is already set or you're still hesitating about your project, take the time to do the following. your SME credit application with Lica. Our specialists are here to advise you free of charge and without obligation. This will make it easier for you to choose the best solution. All the while knowing in advance your company's borrowing capacity.

The sooner you start applying for business financing, the sooner you'll be able to position yourself for a new opportunity. As an entrepreneur, you certainly know how important it is to be able to act quickly when an opportunity arises. By relying on a neutral, independent intermediary like Lica, you can be sure of receiving the best advice and the best business credit solution in Switzerland.