Would you like to know how consumer credit works? Then this article is sure to provide you with all the answers you need. Taking out a private loan is a major commitment over a relatively long period of time. So it's crucial to understand how it works before choosing your private credit solution. In this new article, Lica shares its knowledge to help consumers make the right choices.

Consumer credit is all about mathematics...

If just reading the title makes your heart beat faster or your throat tighten, then skip the next few lines! They don't really matter, apart from amusing the mathematicians.

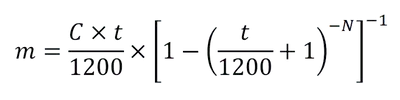

In practice, consumer credit can be summed up in a single mathematical formula:

Not a very sexy formula! But it's the formula lenders use to determine the monthly payment you'll have to make when taking out a consumer loan. Here are the details of this formula:

- m = monthly payment

- C = capital borrowed

- t = borrowing rate in %

- N = duration of loan in months

Now that you know the calculation method, you have two options for simulating the cost of your private credit. Take a sheet of paper, a pencil, your calculator and be patient, or use our simulator at the following link:

The financial aspect is central to the calculation of a consumer loan. However, before determining a monthly payment, a lending institution needs to determine a long-term risk management strategy. We'll look at this in the next chapter.

Risk management

To be profitable, lending institutions need to plan and manage a long-term approach to risk. Lending funds via consumer credit does present risks. To be profitable in the long term, these risks must be kept to a minimum! To achieve this, a lending institution determines its business plan according to a number of key processes. These processes will enable it to guarantee a certain level of profitability. This, despite losses on some of the consumer credit granted. Here are the 3 main risk management processes detailed in this article.

👉 To obtain a consumer loan, you need to have a good credit score.«

Not far from the American system, to obtain a consumer credit, you have to be well known. as a quality borrower. In other words, if you're a regular borrower and a good payer, your score will be very high. On the other hand, if you've never taken out a loan before, your score will be low. With a good score, as a borrower you'll get advantageous terms. But that's not all: a lending institution will establish a control checklist which will determine the precise scoring of each of these borrowers. Here are the different factors that can influence your score.

- Your consumer credit experience

- Your personal situation as a borrower (family, profession, housing, etc.)

- Your ability to repay your loan based on your income and financial situation

To determine a borrower's score, it's crucial to know his or her situation inside out. That's why Lica takes the time necessary to prepare a quality file with each of its customers. A clear, favorable file, will increase your chances obtain a consumer credit with good conditions.

👉 Proof of borrowing capacity

A lending institution's biggest fear is losing its funds. In fact, if a borrower can no longer repay his or her private loan, there's a good chance that the creditor will be obliged to claim what is owed to him or her through a pursuit requisition. In this configuration, it is not uncommon for the debtor (borrower) to refuse to recognize his obligation to repay his consumer credit. The borrower will lodge an opposition, and it will be up to the debtor (the lending institution) to prove his right to repayment. To do this, it submits a complete file to the judge, containing all the elements required to demonstrate that it has granted consumer credit, and has scrupulously verified its customer's borrowing capacity. Generally, the following documents will serve as proof that a detailed analysis of the borrower's situation has been carried out.

- Proof of income, such as salary slips, tax notices or bank statements

- Establish a realistic, documented budget based on the situation at the time the funds are loaned.

- Identification and classification of the borrower according to the usual standards of the lending profession

In the event that the lending institution is unable to prove that it has granted consumer credit in strict compliance with consumer credit law, If the applicant does not have a credit history, he or she may never be able to repay the loan. For this reason, it is crucial that the lending institution establishes a solid file on the applicant before granting a consumer credit.

👉 Setting the interest rate on your consumer credit

In addition to establishing a score and a complete file when granting a consumer credit, the lending institution must ensure a good return on the funds loaned. This is made possible by scrupulously determining the interest rate to be applied to each consumer credit granted. To achieve this, one could imagine a breakdown of the costs to be covered by the lending institution as follows:

- Administrative and advertising expenses

- Current operating expenses

- Remuneration of employees and intermediaries

- Bad debt losses due to borrower insolvency

- The cost of capital borrowed and used to grant consumer credit

- The company's profit margin and shareholder remuneration

In addition, the rate is weighted according to the borrower's score. According to this logic, the rates offered on the Swiss market currently range from 3.9% to 9.95%. The rate obtained when applying for a consumer credit will therefore vary according to the lending institution's cost structure and the individual situation of each borrower. The aim is to cover all the above-mentioned costs.

The Swiss consumer credit market

In Switzerland, there are around ten lending institutions sharing the consumer credit market. When competition is fierce, it's crucial to enlist the help of a neutral, independent intermediary. Each institution applies a different analysis method to your file, and therefore offers more or less advantageous conditions depending on your situation.

When you use Lica's services, you benefit from direct access to the main players in the market, while guaranteeing the highest acceptance rate for your application. Our experts analyze and prepare your application before you apply for a consumer credit. This way, you can avoid unnecessary rejections that could permanently block your application due to incorrect registration at Central credit office (ZEK).

Lica makes it easier to obtain consumer credit

Obtaining a consumer credit on the best possible terms is no mean feat! Given the multitude of providers and the need to submit an impeccable file, it is highly recommended to be accompanied by a quality intermediary. In addition to preparing your file according to the different standards of financial service providers, Lica is able to guide you to the right solution the first time. This saves you time and money, and avoids unnecessary rejections that can be detrimental to your scoring.

Our credit specialists will guide you through the entire consumer credit application process in a neutral and confidential manner!

Do you have any questions before submitting an application? Our advisors are available 7 days a week to answer your questions directly on WhatsApp. Ask us for more information and we'll be happy to help!